03 Jan Rule of 72

A simple mathematical hack to find out few important numbers whenever you are investing.

Rule of 72 is a quick way to find out how much time it will take to double your amoney or to find out the rate of return required to double your money when you invest in any asset like stocks, Mutual funds, FD’s, ULIP’s etc.

So, If you know the rate of returns of the asset in which you are investing, divide that number by 72, you will get the number of years it would require to double your money from that investment, vice-versa, if you know the number of years, divide it by 72, you will get the rate of returns required to double your money.

Easy?

Let us do this quick math on the common investments which we all do it & understand the time it takes to double the money. Assume the amount of investment to be 1 Lac rupees.

- A usual FD which generates 6% return will take how much time to double up your money? (72 / 6) – 12 years

- A PPF account if gives 8% return will take how much time to double up your money? (72 / 8) – 9 years

- A well-diversified Mutual funds if gives 12% return will take how much time to double up your money? (72 / 12) – 6 years

- A savings account if gives 5% return will take how much time to double up your money? (72 / 5) – 14 years

Now the most dangerous

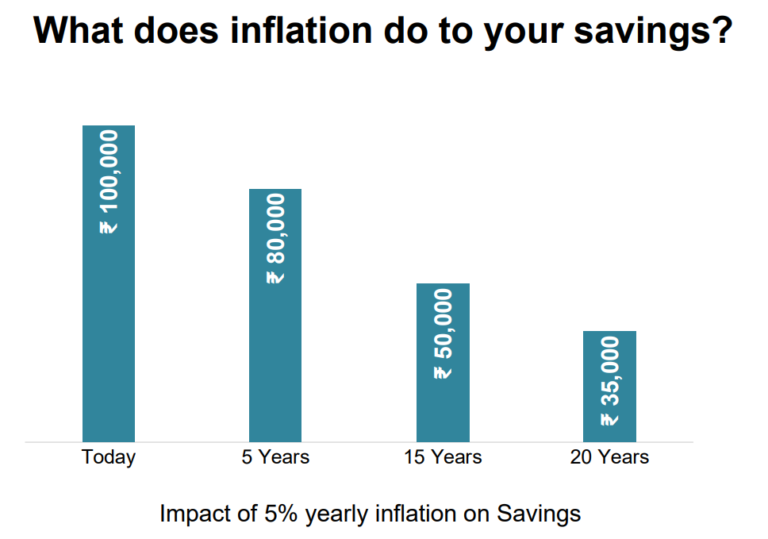

Cost Inflation if stays at 5% year-on-year will take how much time to reduce your money into half ? Assuming if you keep the money at home.

Yes, inflation also grows year on year just like investments. So, if you divide 72 by 5 (72/5) the answer will be 15 years, which means If you keep your 1 lac rupees in safe locker at home, after 15 years the value of your money will reduce to half.

If you keep that same money in FD/ savings account, your money will double in say 12-15 years but so will the inflation. You will feel rich in absolute terms ( as 1 lac will become 2 lacs) but will you will be able to afford the same things which you could afford 15 years back with that 1 lac, nothing more, due to inflation.

"Anything which generates returns at 5-6-7-percentage range is not a good return on your money, at least in the earning age when the objective to invest is to grow your capital more than the inflation rate."

Is Rule of 72 important to know?

Not really, it’s not that important to know this rule. However, it can help sometimes avoid making bad investment choices. How?

Many Investors are advised to invest in things which can double their investment in 3 years which is amazing but how much possible is this?

Let’s apply Rule of 72 here to understand what returns will be required to double the investments in 3 years: Divide 72/3 – The answer is 24%.

So, to double your money, your investment should generate 24% annual returns. Is that possible? I don’t know.

Rakesh Jhunjhunwala (the famous investor) once said: “If I get 18% return on my investment, I am a King & If I get 21% return, I am an Emperor.

Achieving 24% returns is not easy, one can be lucky by investing in stocks few times but doing it consistently it is extremely difficult. Doing this basic mental maths can help you question such investments which on face looks lucrative to invest.

Next time if you get any investment opportunity from an advisor try using rule of 72 to find its doubling rate . It will be fun!

To start investing in Mutual Funds, call us today on 9819078444. We are Wealthsane.com, AMFI Registered Mutual Funds Distributor & Chartered Accountants

*Mutual funds investment are subject to market risk, returns discussed here are purely for informational purpose and not any assurity

Introducing Wealthsane Mobile App.

Now you can get real time access to your investment portfolio using our mobile app.