10 Jan Why you should not invest in Dividend based (IDCW) Mutual Funds?

Why? Just why, people invest in dividend base funds, when instead they have the option to invest in growth?

To check whether you have a dividend-based fund in your portfolio, look at your monthly mutual funds statement. In that, alongside the name of the fund if it’s written IDCW it means you have opted for a dividend. We feel these 3 are the main reasons why people invest in them.

- Either due to ignorance or lack of awareness.

- Invested thinking they will get some fixed income.

- Advised by someone.

So why are dividend based funds not recommended for? Here are the three main reasons.

Reason 1: These are not your actual dividend like you get in shares.

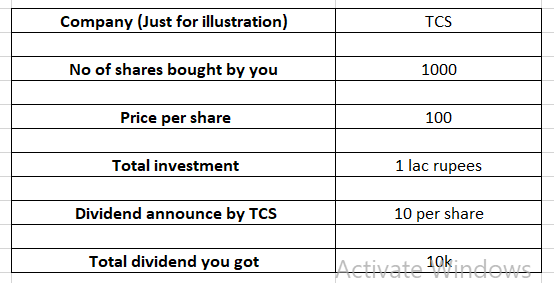

When you invest in shares of a company & not mutual funds, the company’s management decides whether they should pay you any dividend. In case the company decides to pay, here’s how the typical working will look like.

That’s great, you got Rs 10,000 as dividend, and at the end of the day, you are still holding 1000 shares which can appreciate in price, also, the money you got is a reward/bonus as this is over and above your investment and your principal investment in the shares of the company stays as it is which in this case is Rs 1 lac.

Bottomline – Dividends are great when you get them from your investment in stocks!

The problem is that the same rule doesn’t apply to Mutual Funds.

When you invest in a Mutual Fund with a dividend option instead of a growth option, The money given to you as a dividend is not a bonus or any actual dividend received from invested companies but by breaking a part of your own invested capital and the returns generated from it.

Once the dividend is paid, your investment capital is reduced by an equal amount paid to you as a dividend. Not clear?

Let’s see the typical working here

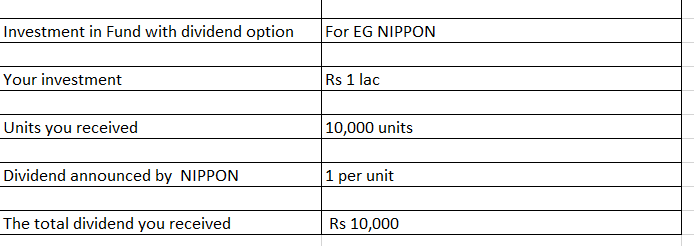

Let’s say you invest 1 lac rupees in Nippon mutual fund* with a dividend option.

Assume in consideration for the Rs 1 lac investment here, you will get units of mutual funds just like you get shares when you invest in a company, assume the number of units you get here is 10000.

100000/10 (price per unit) = 10,000 units

Since you have opted for a dividend, the fund decides to pay you a dividend at the rate of rupees 1 per unit.

So what we have now is

|

Reason 2: Dividends are Taxed

Dividends or dividends reinvested, are first taxed at your income tax slab, so whatever money you get/re-invest will be first taxed. If we take the above example, tax on a Rs 10,000 dividend, assuming you are at 30% slab will be Rs 3000, even if the money doesn’t come to your pocket & directly get re-invested.

Reason 3: Opportunity Cost

When you choose dividend option, you are also losing the potential opportunity to earn extra money had this money stayed invested instead of taken out. For example in the above case Rs 3000 taxed paid by you if stayed invested could possibly become 10,000* in next 8-10 years (assumed rate -12%)

Woah! When you combine the above three reasons and think about it, what you are trying to do is break out your own capital for the sake of a dividend, which is not a dividend, paying tax on it along with it also losing the potential opportunity to earn extra money which got paid as tax.

In short, you are doing this

Summarizing:

Dividend Based funds or IDCW as rightly labeled is a complete no-no for the reasons given above. You should always opt for a growth option while investing and if you think you need regular money from them, invest at least for 4-5 years first, let some capital build up & then take out regular money. We think its more logical, tax efficient and less harmful.