09 Sep How can STEP UP SIP help you reach your Financial Goals Faster?

Step-Up SIP is an enhanced version of the regular Systematic Investment Plan (SIP), where you gradually increase your investment amount over time. Typically, in a regular SIP, you invest a fixed amount every month. However, with a Step-Up SIP, you raise your SIP contribution by a certain percentage, say 10%, every year.

Why Consider a Step-Up SIP ?

- Align Your Investments with Your Growing Income: As your income increases, your financial goals may become more ambitious. Whether it’s planning for a child’s education, a bigger home, or an early retirement, a Step-Up SIP ensures your investments grow along with your aspirations.

- Stay Ahead of Inflation: You know how inflation can erode the value of money over time. By increasing your SIP contributions regularly, you’re not just keeping pace with inflation—you’re staying ahead of it, ensuring that your wealth continues to grow in real terms.

- Maximize the Power of Compounding: The more you invest, the more you benefit from compounding. Even a small increase in your SIP amount can significantly boost your returns over the long term. It’s like giving your existing SIP a turbocharge!

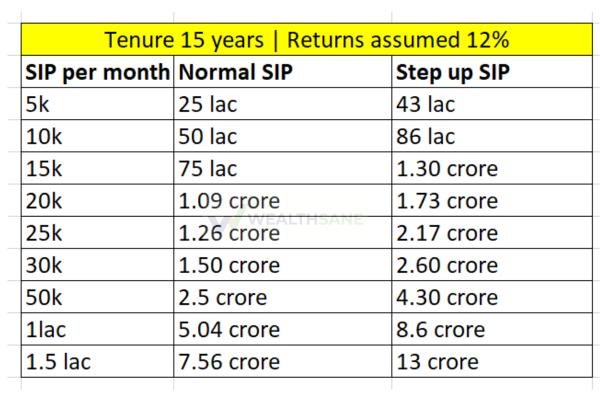

The Impact of a 10% Step-Up SIP Over 15 Years

Let’s consider the following scenario:

- Initial SIP Amount: ₹10,000 per month

- Investment Duration: 15 years

- Expected Rate of Return: 12%* per annum

- Step-Up Percentage: 10% annually

Scenario 1: Constant SIP (No Step-Up)

- Monthly SIP: ₹10,000 (constant)

- Corpus After 15 Years: ₹50.6 Lakhs

Scenario 2: 10% Step-Up SIP

- Starting Monthly SIP: ₹10,000

- Year 2 SIP: ₹11,000

- Year 3 SIP: ₹12,100

- …and so on, with a 10% increase each year.

- Corpus After 15 Years: ₹98.9 Lakhs

The Difference

By simply stepping up your SIP by 10% each year, your corpus at the end of 15 years nearly doubles compared to a constant SIP. Corpus Difference: ₹48.3 Lakhs, That’s an additional ₹48.3 lakhs.

SIP vs Step up SIP (by 10%) returns difference in just 15 years

Why This Matters?

Just by gradually increasing your SIP contributions! This extra amount could be the difference between reaching your financial goals sooner or settling for less than you hoped for.

By opting for a Step-Up SIP, you’re making a smart, disciplined choice that aligns with your growing financial capacity. It’s a simple change, but the impact over time can be significant.

Ready to Maximize Your Investments?

If you’re interested in setting up a Step-Up SIP, we are here to guide you through the process and make sure your investments are working as hard as you do.