23 Dec How to invest Rupees 25 lacs lumpsum in Mutual funds?

There are 2 ways you can invest money in Mutual Funds, one is through SIP (Systematic investment plan) route & the other is through making a lumpsum investment. If you are in the midst of thinking to make any lump sum investments in mutual funds this post will help you as a guiding tool.

First thing first, we think investing in mutual funds via the SIP route is the best method for most investors, as they offer many benefits, however, there are certain times when investor have free cash lying idle in bank savings account or parked in FD’s , it may be due to accumulation from years of savings or due to sale of an ancestral property or a gift from parents, so in cases like this planning a lumpsum investment into mutual funds can be a good idea.

Why?

Not only are they tax efficient but can give far better returns when compared with your traditional investment options like FDs, Gold, insurance & so forth.

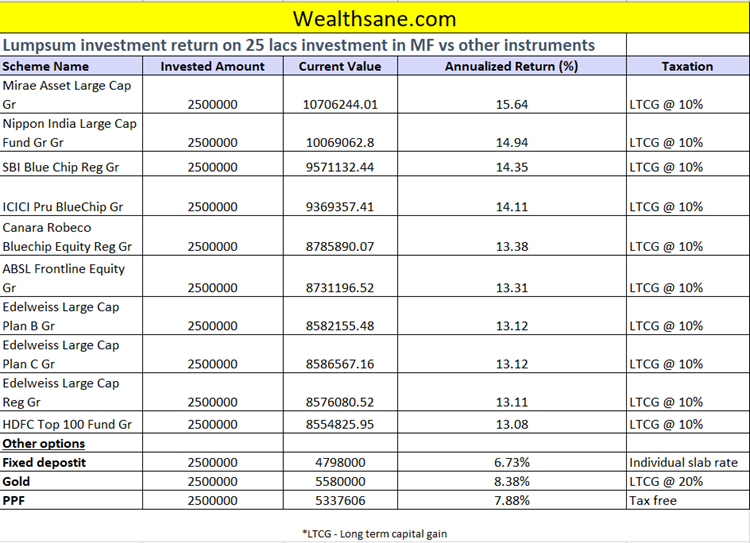

Check this out

10 years investment data from 2013-2023 Investment of 25 lacs in to mutual vs FD vs Gold vs PPF

So, the question is how should you invest this lumpsum amount to work for you?

First & foremost, the most important thing is to take a hard look at your risk appetite, investing 25000 per month as SIP & investing 25 lacs are 2 different things. If your timeline to invest is less than 5 years you should not at all consider investing in equity-based mutual funds, another point is they are volatile, means you should be willing to see negative returns in your investment at least for a while due to market fluctuations. That’s the nature of mutual funds.

Second, you should not put this entire money in one shot, many people make this mistake as they get tempted by attractive outsize returns, However, Markets are impossible to predict in the short term; nobody knows whether they will go down or up. If you put this money in one go and the market goes down by 10-20% it will hurt you.

Sensex movement in last 1 year

The ideal way to invest your lump sum is to first put this into liquid mutual funds (consider them like savings accounts but they give better returns than them) & from there on gradually shift these into equity funds over a 1-year period.

How will this help?

As you do this gradually over 1-year period, you can take advantage of the ups and downs of the market by averaging your cost of buying, and they will go up and down, that is for sure. Any large downward market correction if happens in this 1 year period will be a bonus.

To do this gradual shift from liquid to equity funds, mutual fund houses provide us with a tool called STP (Systemic transfer plan), just like SIP, STP is a tool that helps you to move your money automatically from one fund to another hassle-free without your regular intervention.

Finally, how many funds we should use to invest this lumpsum money?

We think 4-5 funds are good enough diversification, mutual funds on their own are already diversified as they hold shares of at least 30-40 companies, so no point in doing over-diversification.

Once all your money is invested in equity funds just do a periodic review ( 1- year) of your portfolio, if there is a negative return in a particular fund, just review the portfolio it may just be a phase, the underline stocks in the funds might be going through a temporary blip their performance might revert back in time & once the stock performance revert, so will the fund performance.

We hope this was helpful, in case you have any doubts related to Lumpsum investments or anything related to taxation on mutual funds reach us on care@wealthsane.com or call us 9819078444

Happy investing.